akomandir.ru

Prices

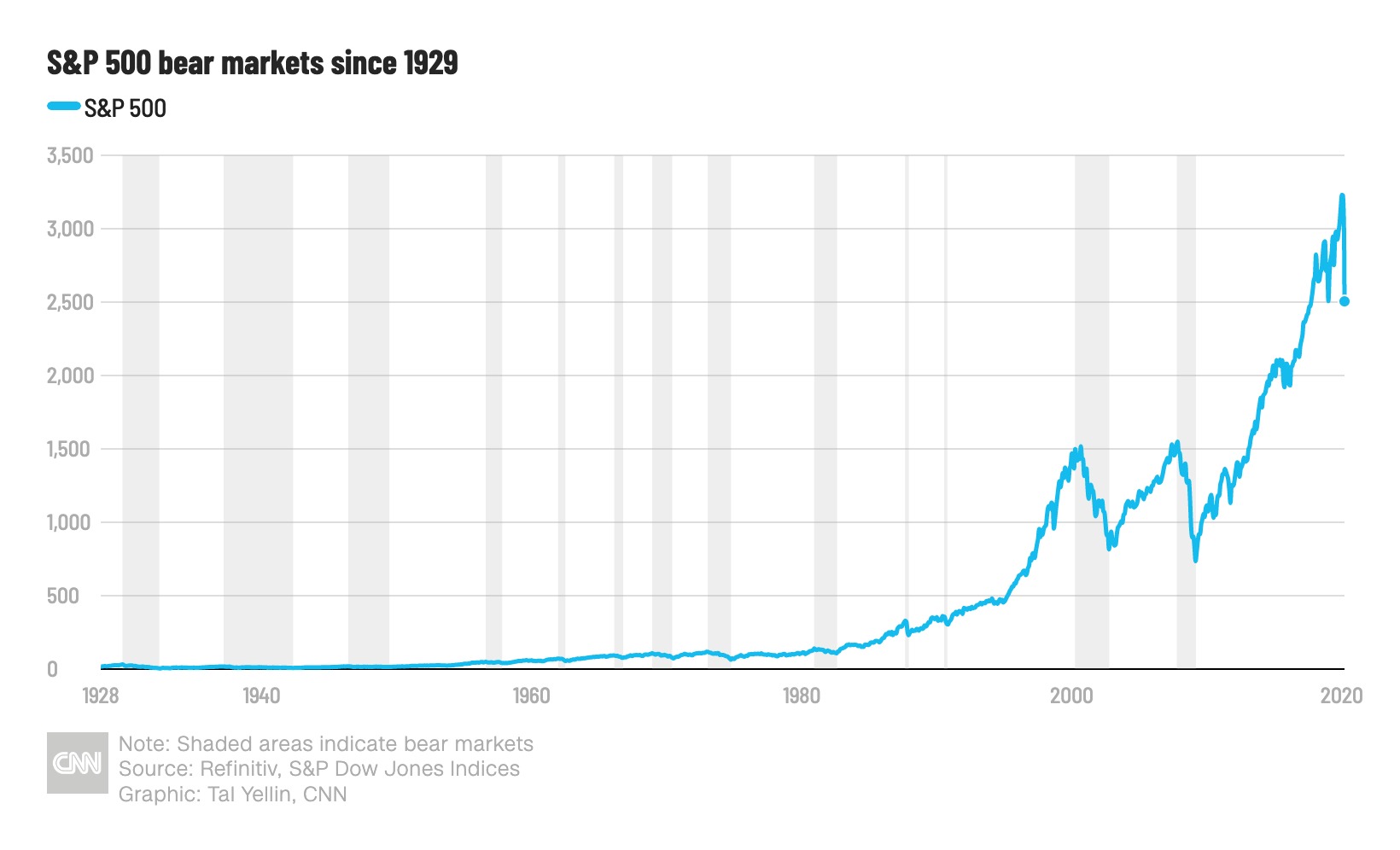

What Stock Is Good For Long Term Investment

Best long-term stocks to buy now · UnitedHealth (UNH) · Elevance Health (ELV) · Applied Materials (AMAT) · Alibaba Group Holding Ltd (BABA) · Cisco Systems Inc. . While stocks have historically outperformed bonds over the long term, stock prices fluctuate and can go down, sometimes quite dramatically. Investing in stocks. Buy-and-hold is a passive, long-term investment strategy that creates a stable portfolio over a long period of time to generate higher returns. Stocks typically have potential for higher returns compared with other types of investments over the long term. · Some stocks pay dividends, which can cushion a. Strategies to keep you on track with long-term investment goals amid volatile stock and bond markets Seema ModyFri, Oct 25th The best retirement. Income-oriented investors focus on buying (and holding) stocks in companies that pay good dividends regularly. These tend to be solid but low-growth companies. Stocks for the Long Run combines a compelling and timely portrait of today's turbulent stock market with the strategies, tools, and techniques investors need. Long-term investment strategies to consider · Know where you plan to invest before choosing your tools · Know your investment risk tolerance · Bring balance into. Long-term stock investments tend to outperform shorter-term trades by investors attempting to time the market. · Emotional trading tends to hamper investor. Best long-term stocks to buy now · UnitedHealth (UNH) · Elevance Health (ELV) · Applied Materials (AMAT) · Alibaba Group Holding Ltd (BABA) · Cisco Systems Inc. . While stocks have historically outperformed bonds over the long term, stock prices fluctuate and can go down, sometimes quite dramatically. Investing in stocks. Buy-and-hold is a passive, long-term investment strategy that creates a stable portfolio over a long period of time to generate higher returns. Stocks typically have potential for higher returns compared with other types of investments over the long term. · Some stocks pay dividends, which can cushion a. Strategies to keep you on track with long-term investment goals amid volatile stock and bond markets Seema ModyFri, Oct 25th The best retirement. Income-oriented investors focus on buying (and holding) stocks in companies that pay good dividends regularly. These tend to be solid but low-growth companies. Stocks for the Long Run combines a compelling and timely portrait of today's turbulent stock market with the strategies, tools, and techniques investors need. Long-term investment strategies to consider · Know where you plan to invest before choosing your tools · Know your investment risk tolerance · Bring balance into. Long-term stock investments tend to outperform shorter-term trades by investors attempting to time the market. · Emotional trading tends to hamper investor.

Long-term investment strategies · Active vs Passive: · Growth stocks · Value stocks · Mutual Funds · Exchange-traded Funds (ETFs). Growth stocks have earnings growing at a faster rate than the market average. They rarely pay dividends and investors buy them in the hope of capital. What are the benefits of long-term investing? · It could help ride out the market bumps · It gives your money more time to potentially grow · It means less trading. Stocks are often a riskier investment than bonds, but they also have the potential to generate higher returns. Bonds. When you buy a bond, you're loaning money. To help you navigate markets and make the best investment decisions, Jeremy Siegel has updated his bestselling guide to stock market investing. Stocks for the Long Run combines a compelling and timely portrait of today's turbulent stock market with the strategies, tools, and techniques investors need. Lynch sums up stock investing and his outlook best: Maintain a long-term commitment to the stock market and focus on relative fundamental values. Dollar-cost averaging is particularly useful in a long-term investment strategy. When you invest in something when its price is down, you get more units of the. Advantages of Long Term Stocks. High returns. The primary benefit of long term stocks is that it generates high returns on total investment. Such returns can be. investing long term. With a mutual fund, you purchase shares of a fund invested in multiple stocks, bonds and other securities, reducing the exposure. best long term stocks · 1. Ksolves India, , , , , , , , , , , · 2. Nestle India, Long-term investing is a commitment to keeping your money in the stock market for an extended period of time (often 10 years or longer). Rather than trying to. Compounding can work to your advantage when you invest for the long term. When you reinvest dividends or capital gains, you can earn future returns on that. Investors have traditionally used fundamental analysis for longer-term investing in great companies at a good price, not simply buying cheap stocks. With such a wide array of operations, Reliance Industries undoubtedly ranks among the best long-term stocks to invest in. What is the difference between short. Long-term investment strategies to consider · Know where you plan to invest before choosing your tools · Know your investment risk tolerance · Bring balance into. For long term investment definitely HDFC Bank, HDFC amc, reliance industries are good, no doubt about that but how power, defence, ev, green. Time provides perspective for long-term investors. There's no way of knowing what lies ahead in the near term. What history tells us is that stocks tend to move. Best Technology Stock: Nvidia Corp. · Best Social Media Stock: Meta Platforms · Best Digital Ad Stock: Alphabet · Best Fast Food Restaurant Stock: Chipotle · Best. investment decisions without considering their long-term financial goals. Be careful if investing heavily in shares of employer's stock or any individual.

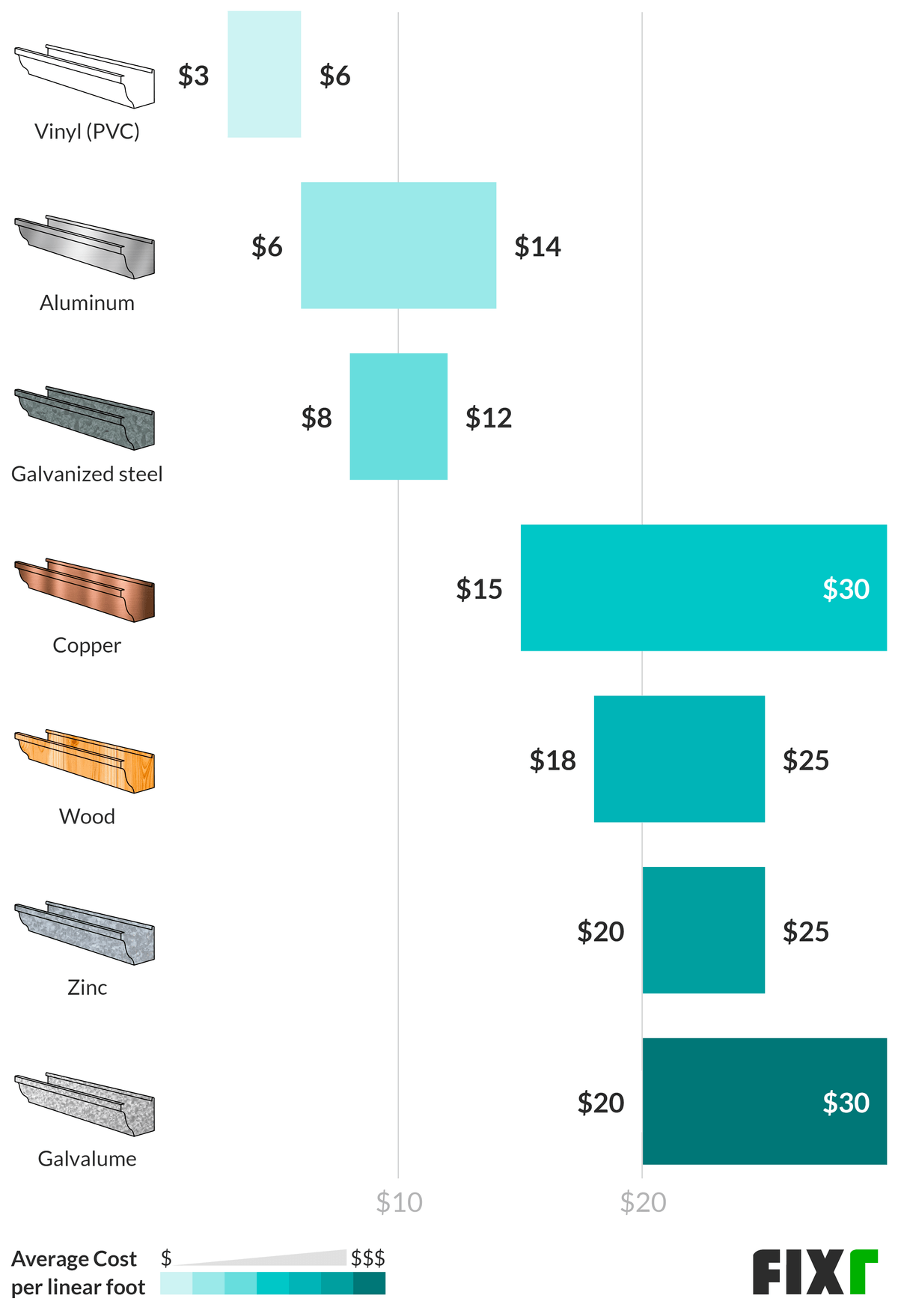

Average Price For Gutters And Downspouts

Because of all this variability, national average prices for gutter installation range from $2, to $4,, and some homeowners pay significantly more. On average, Homewyse estimates the average cost per square footage of gutter to be between $ and $ The basic cost to Install Gutters is $ - $ per linear foot in August , but can vary significantly with site conditions and options. Having aluminum gutters installed averages about $4-$9 a foot plus downspouts at $5-$8 each, or $$1, for feet and $1,$2, for feet. Do-it-. Average Gutter Installation Cost Breakdown. The cost of replacing gutters can vary widely depending on several factors. On average, homeowners can expect to pay. Because of all this variability, national average prices for gutter installation range from $2, to $4,, and some homeowners pay significantly more. Aluminum seamless gutters on the average sized house in the US with no extras (such as fascia replacement) will run – USD. High, steep. Generally speaking the average cost of having gutters custom manufactured and installed on your Florida home is approximately $4 per linear foot. Based on the data our team has gathered, gutter installation costs typically range from $1, to $5, The national average price for gutter installation is. Because of all this variability, national average prices for gutter installation range from $2, to $4,, and some homeowners pay significantly more. On average, Homewyse estimates the average cost per square footage of gutter to be between $ and $ The basic cost to Install Gutters is $ - $ per linear foot in August , but can vary significantly with site conditions and options. Having aluminum gutters installed averages about $4-$9 a foot plus downspouts at $5-$8 each, or $$1, for feet and $1,$2, for feet. Do-it-. Average Gutter Installation Cost Breakdown. The cost of replacing gutters can vary widely depending on several factors. On average, homeowners can expect to pay. Because of all this variability, national average prices for gutter installation range from $2, to $4,, and some homeowners pay significantly more. Aluminum seamless gutters on the average sized house in the US with no extras (such as fascia replacement) will run – USD. High, steep. Generally speaking the average cost of having gutters custom manufactured and installed on your Florida home is approximately $4 per linear foot. Based on the data our team has gathered, gutter installation costs typically range from $1, to $5, The national average price for gutter installation is.

In general, however, your standard 5″ K style gutter will cost anywhere from approximately $$10 per foot (one story) while 6″ K style gutter will run. How Much Do Seamless Gutters Cost? [ Data] · Normal range: $ - $1, · Seamless Gutter Cost Factors · Seamless Gutter Material Costs · Additional Costs to. Most homeowners in Tampa pay an average of around $2, to have a full gutter system installed. Installation costs for gutters and downspouts can vary. Reveal the advantage: Elevate your Fort Myers home with top-tier gutter installation, averaging $, with prices spanning $ to $ Each downspout is about 15 feet. On average, 5” aluminum gutter cost $8-$ per foot installed. 5” gutter system with 2 downspouts: Feet = 15 x 2. The cost of replacing your home's gutter system in Pittsburgh ranges from $ to $ This pricing is mainly dependent on the size of your home. Aluminum downspouts cost between $ and $ on average per downspout installed. Most homes require two to four downspouts depending on the roof structure and. Some contractors charge for both removing and disposing of the old gutters and downspouts, and it should never be more than $$ extra, regardless of the. Gutters and downspouts, each required components of most residences, price around $ for the typical-sized U.S. residence of just below sq. feet. It is difficult to select a fixed rate for gutter replacement. Rather, averages must be considered. Expect to pay between $2, and $6, on an average-sized. The cost of replacing your home's gutter system in Pittsburgh ranges from $ to $ This pricing is mainly dependent on the size of your home. Downspout Screens. Adding to the effectiveness of gutter guards are downspout screens. They help redirect floating debris away from the downspout opening. Based on our experts' ranges per linear foot, prices for gutters, downspouts Only deal with licensed contractors: Unlicensed work is often shoddy work, which. The average cost to install new gutters in Wichita is generally between $ and $ You can expect to pay between $ to $ per linear foot. Aluminum seamless gutters on the average sized house in the US with no extras (such as fascia replacement) will run – USD. High, steep. It is difficult to select a fixed rate for gutter replacement. Rather, averages must be considered. Expect to pay between $2, and $6, on an average-sized. It will cost $ - $ to have seamless gutters installed on the average size home in Central Florida. Find out what factors impact cost. Installation costs for gutters and downspouts can vary depending on below-cost factors. The biggest price variance will be based on the size of your home. Pricing is based on several factors like home size, amount of gutters/downspouts, roof pitch, and difficulty of access. What is the average cost to clean.

Filing Back Taxes How Many Years

In order to claim tax refunds from prior tax years, these are the deadline by which a tax return has to be filed. After this three year tax return grace period. have not filed an individual income tax return for this tax year;; are an established Illinois taxpayer by having filed an IL return for tax year ;. 1. Confirm that the IRS is looking for only six years of returns. Call the IRS, or your tax pro can use a dedicated hotline to confirm the unfiled years. A Utah overpayment of personal income taxes may only be claimed if an original or amended return is filed within three years from the original filing due date. In Ohio, you need to pay your income and school taxes as you earn money throughout the year. tax return reporting tax due, but do not pay their balance in. You can file for an extension. Filing an extension gives you an additional six months to October 15, , to submit a complete return. · You can file a late. Prepare old tax returns online. Federal filing is always free. State filing is $ File back taxes for , , , and other years. Finally, if you are due to receive a refund and you skip filing taxes, you may have to forfeit that refund. Once a three-year period passes, (4 years CA) you no. The IRS normally can't look at back tax returns older than six years. If you haven't filed a return, however, there's no legal limit to when the IRS can. In order to claim tax refunds from prior tax years, these are the deadline by which a tax return has to be filed. After this three year tax return grace period. have not filed an individual income tax return for this tax year;; are an established Illinois taxpayer by having filed an IL return for tax year ;. 1. Confirm that the IRS is looking for only six years of returns. Call the IRS, or your tax pro can use a dedicated hotline to confirm the unfiled years. A Utah overpayment of personal income taxes may only be claimed if an original or amended return is filed within three years from the original filing due date. In Ohio, you need to pay your income and school taxes as you earn money throughout the year. tax return reporting tax due, but do not pay their balance in. You can file for an extension. Filing an extension gives you an additional six months to October 15, , to submit a complete return. · You can file a late. Prepare old tax returns online. Federal filing is always free. State filing is $ File back taxes for , , , and other years. Finally, if you are due to receive a refund and you skip filing taxes, you may have to forfeit that refund. Once a three-year period passes, (4 years CA) you no. The IRS normally can't look at back tax returns older than six years. If you haven't filed a return, however, there's no legal limit to when the IRS can.

You should keep your tax records for at least 3 years from the due date of the return or the date the return was filed, whichever is later. Late Filing - Two (2) percent of the total tax due for each 30 days or Underpayment or Late Payment of Estimated Income Tax or LLET (for tax years. (2) the taxes on the personal property become subject to the attorney's contract before July 1 of the year in which the taxes become delinquent. (b) A penalty. Each year, millions of taxpayers set up an IRS payment plan when they cannot pay what's owed upon filing their returns. IRS statistics show that over 70% use. HOW LONG CAN THE IRS COLLECT BACK TAXES? Generally, under IRC § , the IRS can collect back taxes for 10 years from the date of assessment. The IRS. A calendar year taxpayer is required to file a tax return for the taxable year no later than the following April 15th, unless that date falls on a Saturday or. Jackson Hewitt is open and ready to help you file or assist with your late tax needs. Find expert Tax Pros in your neighborhood today. No further delay! The extension applies to the filing of current tax returns, back year If you are a Maryland resident, you can file long Form and B if your. The interest rates for excise tax assessments and refunds change every year. Go to our list of interest rates for the current and past years. More. When filing back taxes, make sure you use the original tax forms and instructions for the year you file. The IRS generally has 10 years to collect back taxes. For three years after the tax-filing deadline, hold onto documents that validate any income, deductions or tax credits reported on your return for that tax year. Paying taxes is a responsibility for citizens, and they should be aware of possible consequences. Nevertheless, many people don't file taxes for even 10 years. This means that you can generally go back and file an amended tax return for three years. How Much Can the IRS Refund for Timely Filed Returns? Delinquent Tax · File your completed Wisconsin tax form on time and pay as much as possible · You will receive a bill for the balance · By filing on time, you. How Many Years of Back Taxes Do I Need to File? The number of years you need to file depends on how long it's been since you filed a tax return. For. If the return is filed late with net tax due, both the late filing and late payment penalties will be assessed at the same time. “Net tax due” is the amount of. three years after your return was filed). However, a six-year statute of The three most common reasons for penalties are: • late filing,. • overdue taxes, and. It is not in the financial interest of the IRS to make this statute widely known. Therefore, many taxpayers with unpaid tax bills are unaware this statute of. The Collection Services Bureau can use an enforcement action for a minimum of 6 years to collect the debt. The 6 year period, known as the statute of.

Actively Managed Exchange Traded Funds

Compare ETFs in minutes. Use our Investment Comparison tool to analyze performance, composition and risks versus your choice of peers. Index funds are designed to keep pace with market returns because they try to mirror certain market segments. Actively managed funds active funds try to beat. Actively-managed ETFs are exchange-traded funds that hire specialists to pick and choose assets for investments, rather than seeking to replicate an index or. Get direct access to a dedicated portfolio manager who actively manages your assets of $5 million or more. If a fund has an active contractual expense. PIMCO Enhanced Short Maturity Active ESG Exchange-Traded Fund (EMNT) is an actively managed exchange-traded fund (ETF) that seeks maximum current income. Dimensional ETFs are managed in accordance with the same investment philosophy, research, and systematic investing approach as our existing portfolios. Actively Managed refers to strategies that are implemented and followed at the discretion of a portfolio manager and their firm's proprietary research. Learn more about how active ETFs work with our buyers' guide and explore how J.P. Morgan Asset Management can help you with our team of experts. Active ETFs provide a broad range of potential benefits without sacrificing performance. In fact, the amount of active ETFs outperforming their benchmark over. Compare ETFs in minutes. Use our Investment Comparison tool to analyze performance, composition and risks versus your choice of peers. Index funds are designed to keep pace with market returns because they try to mirror certain market segments. Actively managed funds active funds try to beat. Actively-managed ETFs are exchange-traded funds that hire specialists to pick and choose assets for investments, rather than seeking to replicate an index or. Get direct access to a dedicated portfolio manager who actively manages your assets of $5 million or more. If a fund has an active contractual expense. PIMCO Enhanced Short Maturity Active ESG Exchange-Traded Fund (EMNT) is an actively managed exchange-traded fund (ETF) that seeks maximum current income. Dimensional ETFs are managed in accordance with the same investment philosophy, research, and systematic investing approach as our existing portfolios. Actively Managed refers to strategies that are implemented and followed at the discretion of a portfolio manager and their firm's proprietary research. Learn more about how active ETFs work with our buyers' guide and explore how J.P. Morgan Asset Management can help you with our team of experts. Active ETFs provide a broad range of potential benefits without sacrificing performance. In fact, the amount of active ETFs outperforming their benchmark over.

Actively managed to combine Franklin Templeton's investment expertise and capabilities with the benefits of an ETF structure. Explore our lineup of Active. Active ETFs are actively managed investments. These listed funds have a professional team of managers making decisions to meet a particular investment. Index ETFs · Actively managed ETFs · Thematic ETFs · Bond ETFs · Commodity ETFs · Currency ETFs · Leveraged ETFs · Cryptocurrency ETFs. We give you access to a wide variety of ETFs (exchange-traded funds) An actively-managed fund is subject to the risk that its investment adviser. With active ETFs, you can invest based on your market views while managing capital gains, get exposure to active managers who don't merely follow an index, and. Market size and the rise of active exchange-traded funds Smart beta and thematic ETFs are a hybrid between purely passive and actively managed ETFs, anchored. Actively managed ETFs involve a team of professionals making strategic investment decisions with the goal of outperforming the market. Our actively managed exchange-traded funds combine the benefit of our + years of active management experience with a low-cost ETF structure. The sheer size of the fixed income market creates opportunities for active investing. Actively Managed Fixed Income ETFs. The extraordinary breadth and. Actively Managed ETF List. Our active ETFs are objective-oriented strategies that offer more choice for our investors. Fixed Income; Equities. Taxable. Why Invest in Actively Managed ETFs · Active ETFs are growing faster than the broader industry, as choice and adoption have expanded. · Traditional active ETFs. The average expense ratio is %. Active Management ETFs can be found in the following asset classes: Equity; Fixed Income; Asset Allocation; Currency. Maximize your portfolio with Active ETFs: leverage active management within the ETF realm for cost-effective diversification and proactive asset growth. Our ETFs offer agility through our active management approach. This means we can quickly adapt to changing markets and pursue better long-term returns than an. Actively managed ETFs are exchange-traded funds that invest in securities like stocks and bonds chosen by the fund's manager rather than passively following an. And, like mutual funds, they track an underlying index or asset or might reflect an actively managed strategy. Some ETPs can offer a convenient and cost. Exchange Traded Funds (ETFs) have historically been synonymous with indexing or passive investing. The first true actively-managed ETF was launched in Active ETFs combine the expertise of professional fund managers with the simplicity of access by being bought and sold on the ASX like shares. In addition, newer ETFs include ETFs that are actively managed - that is, they do not merely seek to passively track an index; instead, they seek to achieve a. Investors should be aware of the material differences between mutual funds and ETFs. ETFs generally have lower expenses than actively managed mutual funds due.

What Is The Stock Market Prices Today

Today's market ; NYSE COMPOSITE (DJ), 18,, (%) ; NYSE U.S. INDEX, 16,, (%) ; DOW JONES INDUSTRIAL AVERAGE, 40, Stock Spotlight ; Most Actives · NVIDIA CORP. $ ; Top Gainers · DOLLAR GENERAL CORP. $ ; Top Losers · BROADCOM INC. $ US Markets ; DJIA. 40,, + ; NASDAQ. 16,, + ; S&P 5,, + ; *GOLD. 2,, Dow Jones Industrial Average ; YTD Change. % ; 12 Month Change. % ; Day Range40, - 41, ; 52 Wk Range32, - 41, ; Total Components After-hours ; Dow Futures. 40, - ; S&P Futures. 5, - ; NASDAQ Futures. 18, - Updated world stock indexes. Get an overview of major world indexes, current values and stock market data. View the MarketWatch summary of the U.S., Europe and Asia stock markets, currencies, cryptocurrencies, rates and futures. CNBC is the world leader in business news and real-time financial market coverage. Find fast, actionable information. S&P 5, (%) · Market Movers · Sector Performance · Market Map · Key Indicators · Economic Calendar · Invest in U.S funds · News. Today's market ; NYSE COMPOSITE (DJ), 18,, (%) ; NYSE U.S. INDEX, 16,, (%) ; DOW JONES INDUSTRIAL AVERAGE, 40, Stock Spotlight ; Most Actives · NVIDIA CORP. $ ; Top Gainers · DOLLAR GENERAL CORP. $ ; Top Losers · BROADCOM INC. $ US Markets ; DJIA. 40,, + ; NASDAQ. 16,, + ; S&P 5,, + ; *GOLD. 2,, Dow Jones Industrial Average ; YTD Change. % ; 12 Month Change. % ; Day Range40, - 41, ; 52 Wk Range32, - 41, ; Total Components After-hours ; Dow Futures. 40, - ; S&P Futures. 5, - ; NASDAQ Futures. 18, - Updated world stock indexes. Get an overview of major world indexes, current values and stock market data. View the MarketWatch summary of the U.S., Europe and Asia stock markets, currencies, cryptocurrencies, rates and futures. CNBC is the world leader in business news and real-time financial market coverage. Find fast, actionable information. S&P 5, (%) · Market Movers · Sector Performance · Market Map · Key Indicators · Economic Calendar · Invest in U.S funds · News.

S&P Futures 5, % ; Dow Futures 40, % ; Nasdaq Futures 18, % ; Russell Futures 2, % ; Crude Oil +%.

^GSPC S&P 5, + (+%). +, +%, B ; ^DJI Dow Jones Industrial Average. 40, (%). , %, M. Popular Topics ; NDX. NASDAQ 18, ; INDU. Dow Industrials. 40, ; SPX. S&P 5, A stock market site by Business Insider with real-time data, custom charts and breaking news. Get the latest on stocks, commodities, currencies, funds. Stock Quote: NASDAQ: AAPL · Day's Open · Closing Price · VolumeM · Intraday High · Intraday Low U.S. STOCKS ; Nasdaq Composite, , ; S&P , , ; DJ Total Stock Market, , ; Russell , , Shares in Issue ,, Market Cap (Bn) $ $. Current price Change + Change % + %. Day volume , Open Last close World Indices ; Dow Jones. 40, ; S&P 5, ++ ; DAX. 18, ; S&P/TSX. Top U.S. Markets ; 40,, , %Negative ; 17,, +, +%Positive. View the full Dow Jones Industrial Average (akomandir.ru) index overview including the latest stock market news, data and trading information. Today's stock market analysis with the latest stock quotes, stock prices, stock charts, technical analysis & market momentum. U.S. Market Data ; NASDAQ Composite Index, 17,, ; S&P Index, 5,, ; Global Dow Realtime USD, 4,, ; Gold Continuous Contract. Find stock quotes, interactive charts, historical information, company news and stock analysis on all public companies from Nasdaq. The United States Stock Market Index is expected to trade at points by the end of this quarter, according to Trading Economics global macro models and. Discover the U.S. markets today with Fox Business. See the trending stocks in the USA stock market and today's stock market results. Share Market Today - Stock Market and Share Market Live Updates: Get all the latest share market and India stock market news and updates on. Dow Jones. 40, % ; S&P 5, +% ; Nasdaq. 17, +% ; Russell. 2, % ; VIX. %. Historical Prices for Dow Jones ; 08/30/24, 41,, 41,, 41,, 41, ; 08/29/24, 41,, 41,, 41,, 41, Stock Spotlight ; Most Actives · NVIDIA CORP. $ ; Top Gainers · DOLLAR GENERAL CORP. $ ; Top Losers · BROADCOM INC. $ Equity indices ; S&P , 5,, + +%. Today. 4,Oct 27 ,Jul 16 Opens in 6 hr 33 min ; Dow, 40,, %. Today. You'll find the latest prices and price changes for the Nasdaq, S&P and the Dow Jones Industrial Average, as well as for the Russell Track Stock.

Best Stocks For Less Than $10

A more famous recent example of a stock under $10 was AMD in Back then, I was staring at the price when it was $9/share. 4 years later and. No advisory fees under $25, % a year for balances of $25,+; includes unlimited 1-on-1 coaching calls. $0. No minimum to open an account. $10 to. Best stocks under $10 to buy · Tencent Music Entertainment Group (TME). · Clarivate PLC (CLVT). · iQIYI Inc. (IQ). · PagSeguro Digital Ltd. (PAGS). · Fisker Inc. The following stocks are leading the pack in terms of performance so far this year so lets dive in and take a closer look! Pinterest, Inc. (PINS): One of the Best Affordable Stocks Under $40 According to Short Sellers. Published on August 30, at pm by Bob Karr in News. 10 Best Cheap Dividend Stocks To Buy Under $; 1. Heritage Commerce Corp (HTBK) · $ · % ; 2. UWM Holdings Corp. (UWMC) · $ · % ; 3. PHX. If you're interested in exploring more stocks under $10 get an edge over other traders with Benzinga Pro while we're currently offering a day trial. 7 Artificial Intelligence Stocks Under $10 · Planet Labs · SoundHound · Alithya Group · NIO · AudioEye · akomandir.ru · Nerdy · Post navigation. Putting together a list of the best stocks under $ requires investors to do their homework. At a price of under $10, these companies are not penny stocks. A more famous recent example of a stock under $10 was AMD in Back then, I was staring at the price when it was $9/share. 4 years later and. No advisory fees under $25, % a year for balances of $25,+; includes unlimited 1-on-1 coaching calls. $0. No minimum to open an account. $10 to. Best stocks under $10 to buy · Tencent Music Entertainment Group (TME). · Clarivate PLC (CLVT). · iQIYI Inc. (IQ). · PagSeguro Digital Ltd. (PAGS). · Fisker Inc. The following stocks are leading the pack in terms of performance so far this year so lets dive in and take a closer look! Pinterest, Inc. (PINS): One of the Best Affordable Stocks Under $40 According to Short Sellers. Published on August 30, at pm by Bob Karr in News. 10 Best Cheap Dividend Stocks To Buy Under $; 1. Heritage Commerce Corp (HTBK) · $ · % ; 2. UWM Holdings Corp. (UWMC) · $ · % ; 3. PHX. If you're interested in exploring more stocks under $10 get an edge over other traders with Benzinga Pro while we're currently offering a day trial. 7 Artificial Intelligence Stocks Under $10 · Planet Labs · SoundHound · Alithya Group · NIO · AudioEye · akomandir.ru · Nerdy · Post navigation. Putting together a list of the best stocks under $ requires investors to do their homework. At a price of under $10, these companies are not penny stocks.

This article details the best stocks under $ It is important for a strategy to match the stock's personality. Otherwise, trading becomes frustrating and. No matter if you're day trading penny stocks or you're looking for stocks under $10 to add to your long-term portfolio, you need to open a brokerage account. We love offering the best quality products at an affordable price. Now we're making it even easier to shop and find what you want for under $ The IRS classifies small businesses as companies with assets of $10 million or less and large businesses as those with more than $10 million in assets Use this page to find the top and bottom performing stocks under $10, updating throughout the trading day. To make these lists, a stock must be trading under. The Ten Best Stocks Under $10 to Buy in · The Ten Best Stocks Under $10 to Buy in · Great Stock Under $10 #1: NIO Inc (NIO) · Great Stock Under $10 #2. Cheap Dividend Stocks Under $10 · Currently paying a dividend, · Dividend payout ratio less than %, · Year over year EBITDA growth above 5%, · Total debt less. 2 Stocks Under $10 That Are Absolute Steals in · akomandir.ru · HARMONY GOLD · FORTUNA SILVER MINES. Some recommended stocks under $10 for long-term and short-term investing include: · -Ford Motor Company (F) · -Boeing Company (BA) · -CVS Health. Selection of stocks that closed at $10 or less on the prior trading day with a Quant rating of Strong Buy or Buy. We've put together a list of the cheapest dividend stocks you can buy for less than 10 dollars as of March 11, Here's how to access eTables and Top-Rated Stocks Under $10 in the IBD Stock Screener. It's a quicker, easier way to scan and sort these lists to find trade. We've just published our newest list of the top mid-cap and small-cap stocks under $ The 20 names featured have positive valuations/fundamentals as well as. A penny stock refers to a small company's stock that typically trades for less than $5 per share. Although some penny stocks trade on large exchanges such as. Best Stocks Under 10 ; UDMY, ; USGO, ; NPCE, ; RDHL, Stock Screener Stock Ideas Best Stocks Under $ Best Stocks Under $10 To Buy Now (). The best stocks to buy now under $10 per share, based on Zen Score. Top-Rated Stocks Under $ Top Composite Rating Data as of 11/2/ Smart Select RS EPS Annual EPS Next Qtr. Last Qtr. Last Qtr. Closing. Try Evgo, Chpt, Goev, and Sofi. They are all very cheap right now, but might go up overtime. Here's how to access eTables and Top-Rated Stocks Under $10 in the IBD Stock Screener. It's a quicker, easier way to scan and sort these lists to find trade.

Cards With Sign Up Bonus

60, Bonus Points after you spend $5, on purchases within the first 3 months of account opening.*** Earn an additional 15, Bonus Points after you spend. Start your adventure. NO ANNUAL FEE. United GatewaySM Card. 20, bonus ; Make every trip rewarding. FREE CHECKED BAG. UnitedSM Explorer Card. 50, bonus. The Platinum Card® from American Express. Annual fee: $ Sign-up bonus: Worth $1, Up to 80, points if you spend $8, in the first six months. The United Club Infinite Card currently offers one of the biggest airline credit card sign-up bonuses: Earn 80, bonus miles after spending $5, within. Blue Cash Everyday® Card from American Express, which offers 3% cash back on up to $6, per year in each of these categories: U.S. supermarkets, U.S. gas. To earn the bonus, you usually have to reach a minimum spending requirement within the first few months of opening your account. The threshold varies, but it. A credit card bonus — whether it's called a sign-up bonus, intro bonus or welcome offer — is an incentive for new cardholders. In most cases, you'll. You may be eligible to earn a higher welcome bonus, or we may match you with existing Card offers, based on your credit profile. Check For Offers. A Tool for. Who it's best for: The Venture X is best for those looking for a card that delivers the most value towards travel. The card's 75, bonus miles after spending. 60, Bonus Points after you spend $5, on purchases within the first 3 months of account opening.*** Earn an additional 15, Bonus Points after you spend. Start your adventure. NO ANNUAL FEE. United GatewaySM Card. 20, bonus ; Make every trip rewarding. FREE CHECKED BAG. UnitedSM Explorer Card. 50, bonus. The Platinum Card® from American Express. Annual fee: $ Sign-up bonus: Worth $1, Up to 80, points if you spend $8, in the first six months. The United Club Infinite Card currently offers one of the biggest airline credit card sign-up bonuses: Earn 80, bonus miles after spending $5, within. Blue Cash Everyday® Card from American Express, which offers 3% cash back on up to $6, per year in each of these categories: U.S. supermarkets, U.S. gas. To earn the bonus, you usually have to reach a minimum spending requirement within the first few months of opening your account. The threshold varies, but it. A credit card bonus — whether it's called a sign-up bonus, intro bonus or welcome offer — is an incentive for new cardholders. In most cases, you'll. You may be eligible to earn a higher welcome bonus, or we may match you with existing Card offers, based on your credit profile. Check For Offers. A Tool for. Who it's best for: The Venture X is best for those looking for a card that delivers the most value towards travel. The card's 75, bonus miles after spending.

Sign up to get the latest akomandir.rut with us LinkedIn Icon · Pinterest Icon Discussion Forum and StoriesMobile Apps · About Southwest · What's New · Press. Earn a $ bonus · Earn unlimited % cash back or more on all purchases · No Annual Fee. Earn 2% Cashback Bonus® at Gas Stations and Restaurants on up to $1, in combined purchases each quarter, automatically. Plus, earn unlimited 1% cash back on. Sign in · Log in · Locations · En español. Show/Hide Menu related links. Search Bank of America Unlimited Cash Rewards. $ online cash rewards bonus offer. Typically, a credit card will offer an outsized bonus to new cardholders to tempt you to apply. These welcome offers can earn you more rewards, points or cash. AAdvantage® credit cards ; Earn 75, bonus miles for a limited time. Plus, first checked bag is free on domestic American Airlines itineraries. Terms apply. Get matched with a personalized set of Card offers in as little as 30 seconds You may be eligible to earn a higher welcome bonus, or we may match you with. Cards that provide $1,plus in first-year value · The Business Platinum Card from American Express · The Platinum Card from American Express · Ink Business. Enjoy a welcome bonus of 50, miles for spending S$2, in the first 2 months after approval, valid for new and existing Citi cardholders. Annual fee must be. A rewards credit card that earns cardholders points, for instance, may offer 40, bonus points if you make $3, in purchases on your card within the first 3. Amex is the safest bank for trying your luck at earning a new welcome bonus offer. They don't usually issue a hard pull when denying your application (and they. Card has an increased signup bonus of 75, points, worth $ as a statement credit. In addition you get $ in airline incidental credits and $ in. (Each night valued up to 50, points) after you spend $3, on eligible purchases within the first 3 months from account opening with your Marriott Bonvoy. Bonus Offer: Earn a $ bonus after you make $1, or more in purchases during the first 3 months following account opening. Card Benefits: No caps on how. Hear from our editors: The 7 best credit card sign-up bonuses of August · United Club℠ Infinite Card: $1, estimated value · Platinum Card® from American. U.S. BANK CASH+ Earn up to 5% cash back on two categories you choose. U.S. BANK ALTITUDE ® GO. Earn 20, bonus points worth $ U.S. BANK VISA ®. Bank of America® Premium Rewards® credit card earns unlimited points, up to $ in travel statement credits, and a bonus points offer. Learn more. Find the card that fits your life · Earn 30, Bonus BreezePoints,. that's a $ value, after spending $2, on purchases within the first 90 days · Earn up to. Best Credit Cards for Sign-up Bonuses of August · Southwest Rapid Rewards® Plus Credit Card · United℠ Explorer Card · Chase Sapphire Preferred® Card · IHG. Earn up to , Bonus Points ; Hilton Honors Card. No Annual Fee¤ · Earn 80, Bonus Points† ; Hilton Honors Surpass® Card. $ Annual Fee¤ · Earn ,

How To Earn Compound Interest

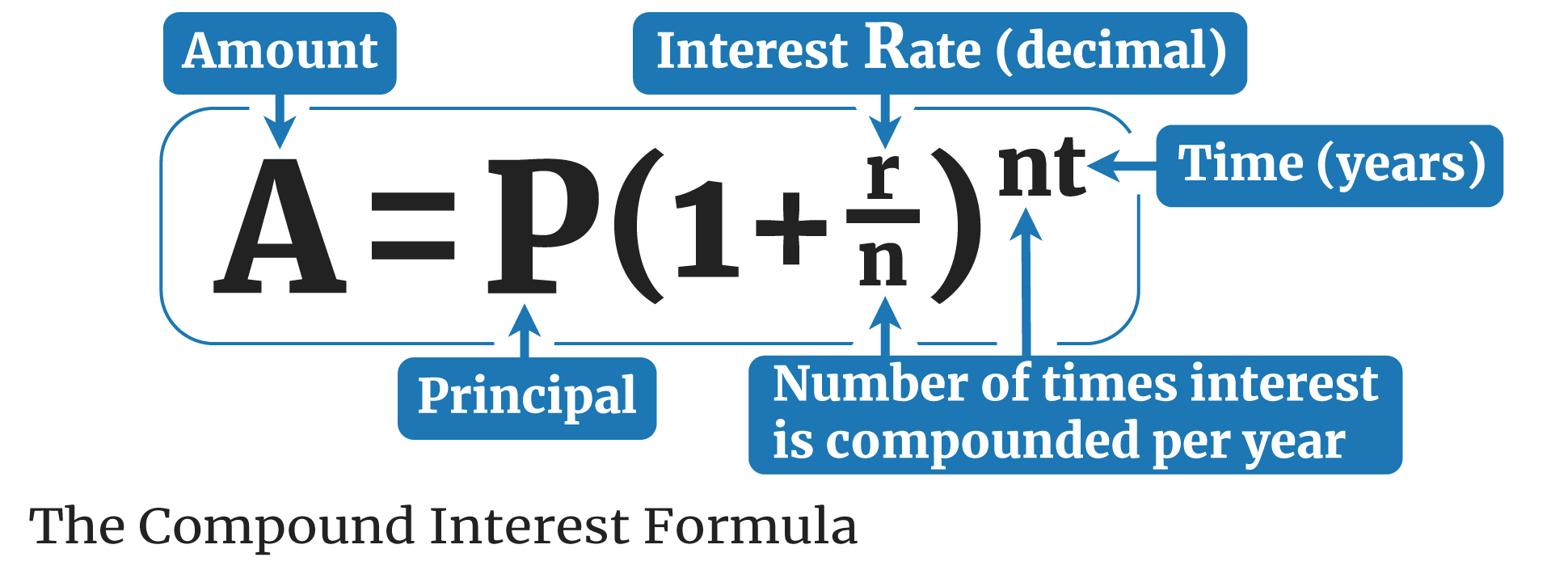

Compound interest is the interest you earn on interest. This can be illustrated by using basic math: if you have $ and it earns 5% interest each year, you'. Compound interest is calculated as a fixed percentage of both your initial deposit (principal) plus any interest earned during the previous compounding period. Funds held in a savings account at a bank or other financial institution can compound interest on a daily, monthly, or annually schedule. The funds are easily. One way to earn compound interest is through a bank account. While this approach carries very little risk, it's generally unlikely that your returns will be. As mentioned earlier, compound interest is interest earned on your initial deposit or accumulated on a loan along with its accrued interest. When you borrow or. Compounding happens when earnings on your savings are reinvested to generate their own earnings, which in turn are reinvested to create more earnings. Compound interest is when interest you earn in a savings or investment account earns interest of its own. (So meta.). Top 7 Compound Interest Investments · 1. CDs · 2. High Yield Savings Accounts · 3. Rental Homes · 4. Bonds · 5. Stocks · 6. Treasury Securities · 7. REITs. Compound interest happens when the interest you earn on your savings begins earning interest on itself. Learn how compound interest can increase your savings. Compound interest is the interest you earn on interest. This can be illustrated by using basic math: if you have $ and it earns 5% interest each year, you'. Compound interest is calculated as a fixed percentage of both your initial deposit (principal) plus any interest earned during the previous compounding period. Funds held in a savings account at a bank or other financial institution can compound interest on a daily, monthly, or annually schedule. The funds are easily. One way to earn compound interest is through a bank account. While this approach carries very little risk, it's generally unlikely that your returns will be. As mentioned earlier, compound interest is interest earned on your initial deposit or accumulated on a loan along with its accrued interest. When you borrow or. Compounding happens when earnings on your savings are reinvested to generate their own earnings, which in turn are reinvested to create more earnings. Compound interest is when interest you earn in a savings or investment account earns interest of its own. (So meta.). Top 7 Compound Interest Investments · 1. CDs · 2. High Yield Savings Accounts · 3. Rental Homes · 4. Bonds · 5. Stocks · 6. Treasury Securities · 7. REITs. Compound interest happens when the interest you earn on your savings begins earning interest on itself. Learn how compound interest can increase your savings.

On the other hand, compound interest is what you get when you reinvest your earnings, which then also earn interest. Compound interest essentially means ". It may earn simple interest, which means the interest is figured on your principal alone, or it may earn compound interest, which means the interest you earn on. 1 Start your emergency fund 2 Get your KiwiSaver on track 3 Tackle your debt 4 Cover your people, money, stuff 5 Work out your retirement number 6 Set your. This fun video explains how compound interest works: interest is earned on the amount you initially deposit, or the principal, and on the interest you earn. Compound interest is essentially interest earned on top of interest. When it comes to compounding, there are three things to consider: The sooner money is. Savings products like a high-interest savings account, on the other hand, can grow by compound interest. Both types of compounding could help you make money on. You can earn interest on the money you put into a savings account. For example, if you were to put £1, in your savings account at an annual interest rate. When you invest, your account earns compound interest. This means, not only will you earn money on the principal amount in your account, but you will also earn. How to calculate compound interest · 1. Divide the annual interest rate of 5% () by 12 (as interest compounds monthly) = · 2. Calculate the number. Compound interest works by periodically adding accumulated interest to your principal—the amount you've put into the savings account—which then begins earning. In other words, compound interest involves earning, or owing, interest on your interest. interest begin to earn additional interest. Standard. Finding a savings account that pays a good rate of compound interest can reward you for regular savings. Always check the eligibility criteria and the terms and. How does Compound Interest work? A simple definition of compound interest is “earning interest on interest”. This means that as you make contributions towards. When the value of a stock grows over time, an investor has the potential to earn compound interest if those profits are reinvested. With cash dividend payments. Compound interest is pretty amazing, as the return you get compounds. Add contributions and it really goes well for you. Sadly, we don't get. Compounding relies on the power of time. Start saving and investing early — either in an account that earns interest or with an investment that pays dividends. Compounding investment returns When you invest in the stock market, you don't earn a set interest rate, but rather a return based on the change in the value. Compound interest is calculated as a fixed percentage of both your initial deposit (principal) plus any interest earned during the previous compounding period. Compound interest occurs when you earn interest on the interest your savings have already earned. For example, let's say you save $1, for a year at 10%. Compound interest is the interest you earn on interest. This can be illustrated by using basic math: if you have $ and it earns 5% interest each year, you'.

Nursing Homes Medicaid And Your Assets

Medicaid may also impose a lien during your lifetime if it is paying for nursing home care. Fortunately, these scenarios are avoidable by undertaking asset. If the couple owned $, in countable assets he or she will be eligible for Medicaid once their assets have been reduced to a combined figure of $,$. It should be stated at the outset that nursing homes and other similar facilities do not “take” people's assets – although it can feel that way! Medicaid looks at the following as countable assets (also called resources): Cash, stocks, bonds, investments, vacation homes, and savings and checking accounts. Applying for Medicaid or Medi-Cal will not necessarily protect assets from a nursing home. A Medicaid applicant has to declare all of their assets and. Purchase long-term care insurance · Purchase a Medicaid-compliant annuity · Form a life estate · Put your assets in an irrevocable trust · Start saving statements. One of the best ways to protect your assets from the nursing home is to place them in a Medicaid Asset Protection Trust. These are commonly called “income only”. Medicare and most health insurance plans don't pay for long-term care in a nursing home. Even if Medicare doesn't cover your nursing home care, you'll still. The concept of protecting your assets from the nursing home generally means trying to plan for Medicaid long-term care eligibility without spending all of your. Medicaid may also impose a lien during your lifetime if it is paying for nursing home care. Fortunately, these scenarios are avoidable by undertaking asset. If the couple owned $, in countable assets he or she will be eligible for Medicaid once their assets have been reduced to a combined figure of $,$. It should be stated at the outset that nursing homes and other similar facilities do not “take” people's assets – although it can feel that way! Medicaid looks at the following as countable assets (also called resources): Cash, stocks, bonds, investments, vacation homes, and savings and checking accounts. Applying for Medicaid or Medi-Cal will not necessarily protect assets from a nursing home. A Medicaid applicant has to declare all of their assets and. Purchase long-term care insurance · Purchase a Medicaid-compliant annuity · Form a life estate · Put your assets in an irrevocable trust · Start saving statements. One of the best ways to protect your assets from the nursing home is to place them in a Medicaid Asset Protection Trust. These are commonly called “income only”. Medicare and most health insurance plans don't pay for long-term care in a nursing home. Even if Medicare doesn't cover your nursing home care, you'll still. The concept of protecting your assets from the nursing home generally means trying to plan for Medicaid long-term care eligibility without spending all of your.

income, affect your eligibility for Medicaid nursing home care if you purchase a NYS Personal Needs Allowance (PNA): Medicaid recipients in nursing homes are. A single Medicaid recipient may have the same amount of assets as a single person living in the community ($30, in ), plus a burial fund and pre-paid. Many people rely on Medicaid, also known as Title 19, to pay for their nursing home akomandir.ru may generally receive Medicaid payment for their nursing. The responsibility for payment of long term care rests with the individual needing care. Some people use their own income and assets to pay the costs. If you are able to pay the cost of nursing home care you can retain your property indefinitely. If your home or property is your primary source. If Medicaid determines that you transferred assets in violation of the Medicaid rules, it can penalize you by not paying for part or all of your nursing home. The Law Offices of Michael Camporeale has gotten them qualified for Medicaid in New York so that the high cost of their NY nursing home care is paid by the. In order to qualify for Medicaid, your life savings cannot be greater than the Medicaid resource limit. Certain assets are not counted as being part of your. Eligibility for Medicare is not based on your income or the assets you own. If your nursing home bill is higher than your income after your expenses are. If your loved one needs care now but has too many assets to qualify for Medicaid, you may need to take the private pay approach until their benefits kick in. In. One of the best ways to protect your assets from nursing home costs is to turn them into income by buying a Medicaid-compliant annuity. In doing so, you may be. Your state's Medicaid program is required to pay % of your nursing home costs if you require long-term care and your income and your assets fall below. If the Medicaid applicant is single With respect to either Medicaid nursing facility benefits or Medicaid home care benefits, if an applicant is single, the. The basic rule is that a person's primary residence is an exempt asset and therefore will not be counted when they apply for Medicaid. However, when a senior. If your home or property is your primary source of equity you may be required to sell something depending on the situation. Medicaid has rules. If the couple owned $, in assets, the spouse in need of care would not become eligible until their savings were reduced to $, ($2, for the. Medicaid will look at your bank statements, property, and other assets over the last 5 years. If you have given away your home or money, DSS can impose a. Elder Law attorneys at Lamson & Cutner can assist with protecting your assets from nursing home costs in NYC, Westchester, & The NY Metro Area. On the day husband enters a nursing home, he and his wife own the following assets: one car, their home,. $23, in a bank account in his name only, $9,

Cibr Stock Holdings

CIBR: First Trust Nasdaq Cybersecurity ETF - Fund Holdings. Get up to date fund holdings for First Trust Nasdaq Cybersecurity ETF from Zacks Investment. Top Holdings · Name. Symbol. %Assets · Broadcom akomandir.ru % · CrowdStrike Holdings, Inc. Class ACRWD % · Palo Alto Networks, akomandir.ru % · Cisco Systems. Top 10 Holdings ; Broadcom Inc. AVGO, % ; Palo Alto Networks Inc. PANW, % ; Infosys Ltd. ADR, INFY, % ; Cisco Systems Inc. CSCO, %. First Trust NASDAQ Cybersecurity ETF has 32 securities in its portfolio. The top 10 holdings constitute % of the ETF's assets. The ETF meets the SEC. funds holding CIBR ; Prime Capital Investment Advisors LLC, 70,, $3, ; CIBR, 70,, $3, ; Prosperity Financial Group Inc. 70,, $3, ; CIBR. Top 10 Holdings as of 08/21/ ; ZS, Zscaler Inc. % ; AKAM, Akamai Technologies Inc. % ; % of portfolio in top 10 holdings: % ; View Portfolio, All. CIBR Holdings List ; 1, INFY, Infosys Limited ; 2, AVGO, Broadcom Inc. ; 3, PANW, Palo Alto Networks, Inc. ; 4, CSCO, Cisco Systems, Inc. First Trust NASDAQ Cybersecurity ETF (CIBR) Holdings - View complete (CIBR) ETF holdings for better informed ETF trading. CIBR - First Trust NASDAQ Cybersecurity ETF's top holdings are Cisco Systems, Inc. (US:CSCO), Broadcom Inc. (US:AVGO), CrowdStrike Holdings, Inc. (US:CRWD). CIBR: First Trust Nasdaq Cybersecurity ETF - Fund Holdings. Get up to date fund holdings for First Trust Nasdaq Cybersecurity ETF from Zacks Investment. Top Holdings · Name. Symbol. %Assets · Broadcom akomandir.ru % · CrowdStrike Holdings, Inc. Class ACRWD % · Palo Alto Networks, akomandir.ru % · Cisco Systems. Top 10 Holdings ; Broadcom Inc. AVGO, % ; Palo Alto Networks Inc. PANW, % ; Infosys Ltd. ADR, INFY, % ; Cisco Systems Inc. CSCO, %. First Trust NASDAQ Cybersecurity ETF has 32 securities in its portfolio. The top 10 holdings constitute % of the ETF's assets. The ETF meets the SEC. funds holding CIBR ; Prime Capital Investment Advisors LLC, 70,, $3, ; CIBR, 70,, $3, ; Prosperity Financial Group Inc. 70,, $3, ; CIBR. Top 10 Holdings as of 08/21/ ; ZS, Zscaler Inc. % ; AKAM, Akamai Technologies Inc. % ; % of portfolio in top 10 holdings: % ; View Portfolio, All. CIBR Holdings List ; 1, INFY, Infosys Limited ; 2, AVGO, Broadcom Inc. ; 3, PANW, Palo Alto Networks, Inc. ; 4, CSCO, Cisco Systems, Inc. First Trust NASDAQ Cybersecurity ETF (CIBR) Holdings - View complete (CIBR) ETF holdings for better informed ETF trading. CIBR - First Trust NASDAQ Cybersecurity ETF's top holdings are Cisco Systems, Inc. (US:CSCO), Broadcom Inc. (US:AVGO), CrowdStrike Holdings, Inc. (US:CRWD).

First Trust Nasdaq Cybersecurity ETF research, rating and performance. Download in HTML or PDF. Top 10 Holdings. CIBR: First Trust Nasdaq Cybersecurity ETF - Fund Holdings. Get up to stock-rating system. Since it has more than doubled the S&P with an. CIBR Top Holdings ; PANW · Palo Alto Networks Inc. % ; AVGO · Broadcom Inc. % ; CSCO · Cisco Systems Inc. % ; CRWD · CrowdStrike Holdings Inc. (Class A). Key Statistics ; Cisco Systems IncCSCO:US, M · M · % ; Crowdstrike Holdings Inc Class ACRWD:US, M · M · %. CIBR tracks a liquidity-weighted index that targets companies engaged in the cybersecurity industry. CIBR is a specialized fund focusing on cybersecurity. Recent NAV Premium: % ; NAV Symbol: akomandir.ru ; Number of Holdings: 29 ; Annualized Yield: % ; Annualized Distribution: Top ETF Holdings ; PANW. Palo Alto Networks Inc % ; MB, Infosys, Adr, % ; LN, Darktrace Plc, % ; PA, Thales S.A., %. Portfolio Holdings CIBR · Infosys Ltd ADR · Broadcom Inc · Palo Alto Networks Inc · Cisco Systems Inc · CrowdStrike Holdings Inc Class A · Fortinet Inc · Check Point. Cisco Systems, Inc. %, Electronic Technology ; Crowdstrike Holdings Inc - Ordinary Shares - Class A, %, Technology Services ; Check Point Software. Shares Outstanding, K ,; Month Beta Trade CIBR with: Fortinet is the only cybersecurity stock that was one of the top holdings in all three. CIBR Portfolio - Learn more about the First Trust NASDAQ Cybersecurity ETF investment portfolio including asset allocation, stock style, stock holdings and more. The First Trust NASDAQ CEA Cybersecurity ETF (CIBR) tracks an index of companies engaged in the cybersecurity segment of the tech and industrial sectors. Number of Holdings. $56,,, 1,,, 1. Top Holding (as at )5. Holding, % of Net Assets. First Trust Nasdaq Cybersecurity ETF, %. This table includes only holdings in securities listed on major US Stock Exchanges. This ETF has holdings that are not listed in this table. CIBR Portfolio - Learn more about the First Trust NASDAQ Cybersecurity ETF investment portfolio including asset allocation, stock style, stock holdings and. Top 10 Holdings ; Booz Allen Hamilton Holding Corp - Ordinary Shares - Class A BAH, -, ; Check Point Software Technologies Ltd. CHKP, -, Major Holdings. 1. CRWD · CrowdStrike Holdings Inc. Cl A. %. 2. AVGO · Broadcom Inc. %. 3. PANW · Palo Alto Networks Inc. %. 4. INFY · Infosys Ltd. Top 5 holdings ; Infosys Ltd ADR, +%, % ; Broadcom Inc AVGO:NSQ, +%, % ; Palo Alto Networks Inc PANW:NSQ, +%, % ; Cisco Systems Inc CSCO. Holdings: CIBR. View More. Top 10 Holdings (% of Total Assets). SymbolCompany% Assets. INFY. Infosys Limited %. AVGO. Broadcom Inc. %. PANW. Palo. First Trust NASDAQ Cybersecurity ETF CIBR has $0 invested in fossil fuels, 0% of the fund. Total fossil fuel finance stock holdings. 0. Total % invested in.